Barcelona cements the 5th Circular Construction Summit as Southern Europe’s leading platform to accelerate the transition towards a sustainable built environment

10 de December de 2025

Circular Capital strengthens its leadership in sustainable investment and unveils its roadmap for 2026–2028

15 de December de 2025Concrete accounts for roughly 7% of global CO₂ emissions, making its decarbonisation essential to meeting climate goals. At the V Circular Construction Forum, The Climate Group presented ConcreteZero, a global coalition launched in 2022 to shift the concrete market toward low-emission solutions.

The workshop, led by Marta Dawydzik and The Climate Group team, combined technical insights, an overview of the Spanish market, a fireside chat with Cristina Sendrá (Eco Intelligent Growth), and interactive group discussions with industry stakeholders. The goal: identify real barriers and activate practical solutions to scale low-carbon concrete in Spain.

Circular Construction Summit 2025 · Grupo Construcía

What Is ConcreteZero and Why Does It Matter for Spain?

ConcreteZero brings together companies that specify, design, or build with concrete under a shared commitment:

achieving net-zero concrete by 2050, driving faster innovation and adoption of new solutions.

The initiative is pushing for clearer standards, common metrics, and a unified language for defining “low-carbon concrete,” helping reduce technical uncertainty and enabling reliable comparisons.

In Spain, ConcreteZero arrives at a critical moment. The national decarbonisation roadmap for cement still relies heavily on:

- incremental efficiency improvements in clinker production,

- limited clinker substitution,

- biofuels,

- and carbon capture and storage technologies (CCUS).

To accelerate progress, the demand side — builders, developers, and the public sector — needs to take a more active role.

Key Barriers to Scaling Low-Carbon Concrete in Spain

During the workshop, participants converged on four main clusters of barriers:

- Outdated Regulations and Standards

Spain — like much of Europe — lacks regulations that fully support:

- alternative cements,

- recycled aggregates,

- novel binders,

- or lower-emission concrete formulations.

Although project supervisors could technically approve these materials through performance-based criteria, this almost never happens due to:

- increased professional liability,

- insurers refusing to cover non-standardised solutions.

This reinforces a risk-averse culture that stalls innovation, even when viable technologies exist.

- Economic Barrier: The “Green Premium”

Low-carbon concrete often comes with a higher upfront cost.

Without strong demand or public incentives, this price gap discourages adoption.

Participants noted that scaling, green public procurement, and regulatory alignment could significantly reduce the premium.

- Lack of Strong Market Demand

With no mandatory requirements or clear incentives, most projects default to conventional concrete.

This creates a vicious cycle:

low demand → limited competitive supply → higher cost → more inertia.

- Cultural and Professional Inertia

The construction sector still operates under linear, conservative logics:

- repeating traditional methods,

- avoiding perceived risks,

- focusing on short-term cost,

- lacking knowledge about available alternatives.

Workshop discussions confirmed that many project teams do not yet know how to specify low-carbon concrete or assess its real impact.

Insights from the Climate Group – EIG Fireside Chat

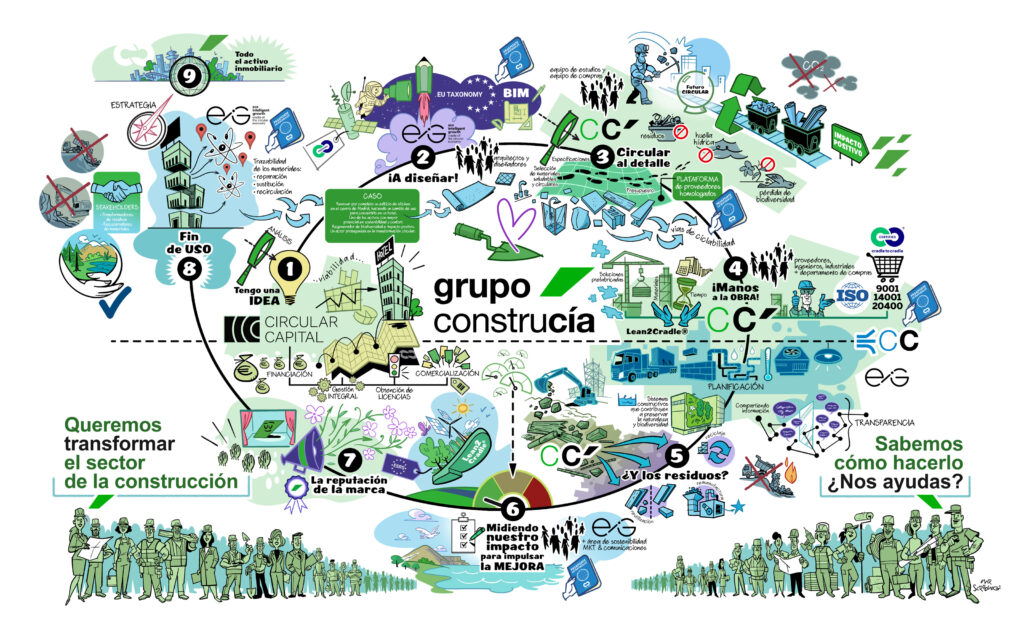

The conversation between Marta Dawydzik (Climate Group) and Cristina Sendrá (EIG) brought several key points:

- At Grupo Construcía, 99% of emissions come from Scope 3, with 97% linked to goods and services.

- The company approaches decarbonisation through a holistic lens:

- circular design,

- Cradle to Cradle Certified® materials,

- and full life-cycle and impact cost assessment (LCSA) led by Eco Intelligent Growth.

- Transforming the built environment requires expanding the focus beyond concrete to include materials, processes, the supply chain, and business models.

A Market Beginning to Shift

The workshop also showcased emerging initiatives in Spain, such as ECOPact by Holcim and new industrial innovation programmes.

While the road ahead remains uncertain, it is increasingly clear that the transition brings significant opportunities for early movers.